Not too many years from now, business and program planners will have a new challenge when preparing a product or business plan. Since the dawn of the Industrial Age, the state of practice has been to estimate an ROI by forecasting product revenues and profits. Soon, product and business plans will contain two forecasting spreadsheets. There will be the section on product revenues and profits that we are all familiar with. And, there will be revenue and profit forecasting for IP.

Work on financial liquidity and monetization of IP began in the 1990s. Baruch Lev at NYU is often credited with lighting the torch. Let’s define financial liquidity as the ability to more easily transact IP in the marketplace as a commodity. Let’s define monetization as the ability to assign a dollar value to a block of IP, and the rate that the initial value depreciates over time. Liquidity and monetization are different challenges. One requires a marketplace(s) capable of transacting assets, commodities. The other requires the ability to assign a recognized value that can be generally agreed. Just to pronounce the point, some day we might see certain types of IP traded like gold, silver, and soybeans. The market would have much less volume, but the principles would largely be the same. So how do we get there?

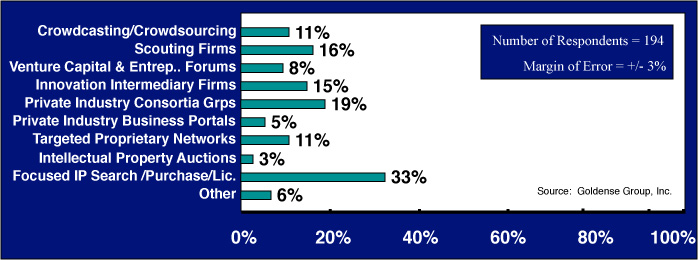

Financial Liquidity: Markets are already in development [Figure 1]. There are a number of them and they are all emerging. Who knows the ones that will stand the test of time. And, the new ones are certain to emerge. Right now “scouting firms,” “innovation intermediaries,” “ip auctioneers,” and “crowdsourcing companies” all stand to be market makers. There are a handful of others. The front half of industry is engaged in testing the waters at some level. It typically takes about half of industry to be active before software developers start generating applications to manage new activities. Software began to emerge at an increasing rate the past couple of years.

Figure 1

Percentage of Companies Currently Utilizing One or More IP Markets

Monetizaton: Quietly, over the past twenty years, there have been committees and groups studying the merits of actually putting IP assets into financial statements. A partial list reads like alphabet soup, but you’ll probably recognize them: SEC, COMEX, FASB, and NAA. Their goal is to be able to assign a value to a block of IP such that it can be treated like a new furnace or truck or mainframe and placed on the balance sheet as an asset and depreciated. To meet generally accepted accounting principles, both a depreciation rate and a liquidation value would have to be determinable. It is not necessary for all this to be worked out before the market can become liquid however, but some level of progress is necessary to determine ranges of salable values. The accountants are currently paying attention to transacted values today that are agreed by a selling and buying entity. After thousands of transactions occur in the years ahead, there will be enough data to assign some standard values. There is great argument however. Many do not want standard values. Companies may lose their ability to negotiate premiums for their prized jewels.

Planning for Intellectual Property Revenues [Machine Design – July 2015] discusses the inevitable advancement of IP into the everyday business planning and decision making processes associated with new products. The article concludes with a bit of stretch thinking.

![Goldense Group, Inc. [GGI] Logo](https://goldensegroupinc.com/blog/tangible-innovation/wp-content/uploads/2022/03/logo-corp-darkBlue-65x65.png)